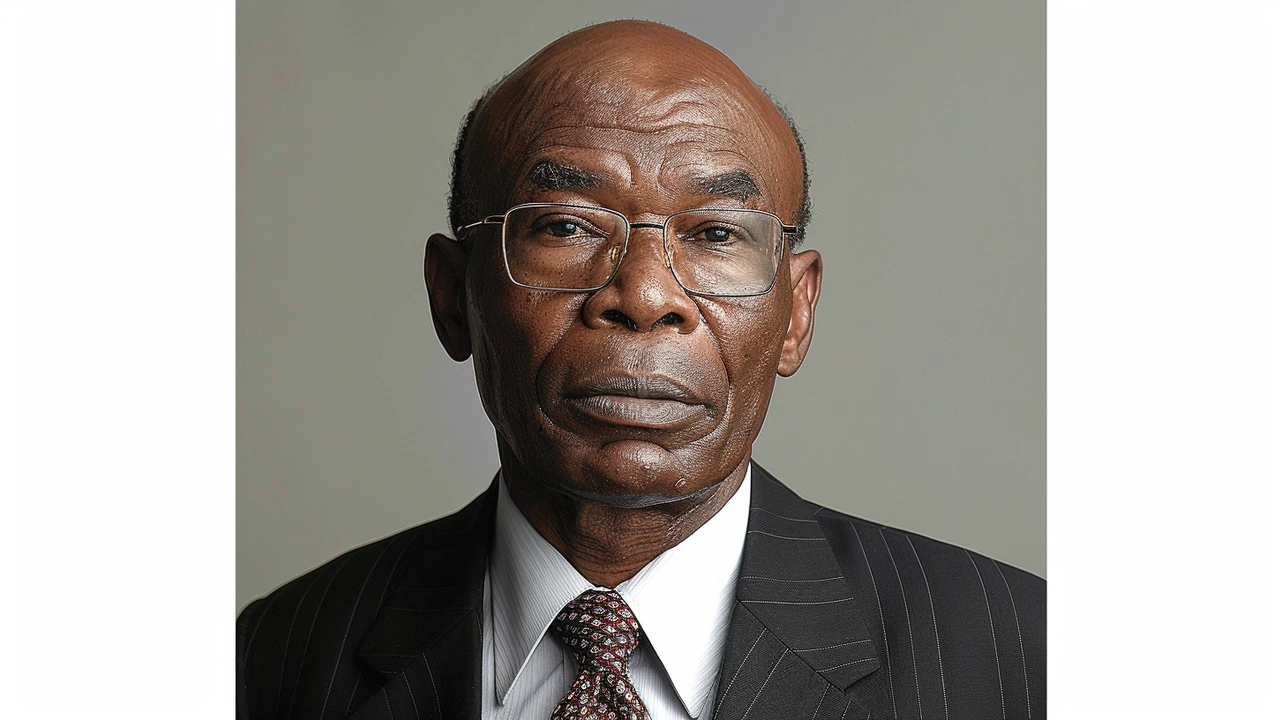

Billionaire S.K. Macharia Shuts Down Directline Assurance Company Over Massive Financial Mismanagement

In a dramatic turn of events, billionaire S.K. Macharia has decided to close down Directline Assurance Company, terminating all employee contracts immediately. This move comes on the heels of the Insurance Regulatory Authority's (IRA) decision to freeze Directline's bank accounts, prompting a series of actions aimed at mitigating the fallout from the alleged misappropriation of over Sh7 billion by the company's former directors.

According to Macharia, the closure was unavoidable given the scale of financial mismanagement that had gone unchecked within the company. Directline Assurance, a major player in Kenya's insurance market, holds a significant 60% market share, particularly in motor insurance. However, the company had been experiencing severe financial pressures, reporting underwriting losses amounting to Sh576.22 million in the first half of 2023.

The Catalyst: IRA's Action to Freeze Bank Accounts

The Insurance Regulatory Authority's intervention by freezing Directline's bank accounts was the catalyst for Macharia's drastic decision. He alleged that the IRA failed to address the root causes of financial mismanagement within the company, leaving no option but to shut it down. The IRA, tasked with overseeing the insurance sector in Kenya, has yet to issue a public response to these allegations or the resultant closure of Directline.

The sudden shutdown of Directline has sent shockwaves through the industry, raising serious questions about the efficacy of regulatory oversight in Kenya's insurance sector. Market analysts are concerned about the potential ripple effects this closure may have on market stability and consumer confidence, especially given Directline's dominant position.

Impact on Employees and the Market

With the immediate termination of all employee contracts, hundreds of workers now find themselves without a job. This abrupt loss of employment is not only a personal crisis for those affected but also a broader economic concern. The job market is being flooded with former Directline employees, which could potentially lead to increased competition for available positions in the insurance and financial sectors.

For many, the failure of Directline, a key player in the industry, underscores the fragile state of corporate governance and accountability within Kenya's financial markets. Industry experts argue that the IRA should have acted sooner and more decisively to address the issues plaguing Directline. Instead, the belated intervention has left the company and its stakeholders in a precarious position.

Royal Credit Limited Steps In

To mitigate the financial impacts of Directline's closure, Royal Credit Limited will take over the company's assets. While this move is intended to stabilize the situation, it remains to be seen how effective it will be in addressing the underlying financial woes. The transition of assets to Royal Credit is closely watched by market participants who are hopeful but cautious about the long-term implications.

The failure of Directline Assurance is therefore not just a story of financial mismanagement; it is a stark reminder of the importance of regulatory vigilance and corporate governance. As the dust settles, all eyes will be on the IRA and Royal Credit Limited to navigate this crisis and restore confidence in the market.

Looking Ahead: Regulatory Oversight and Market Stability

The closure of Directline Assurance will undoubtedly have lasting effects on Kenya's insurance industry. In the short term, the market must come to grips with the sudden loss of a major player. Longer-term, however, the focus will likely shift to improving regulatory frameworks to prevent such occurrences in the future.

There are calls from industry stakeholders and experts for more robust and proactive oversight mechanisms. Ensuring transparency and accountability within insurance firms is critical for protecting both consumers and the stability of the financial market. The Directline saga may serve as a catalyst for significant regulatory reforms aimed at preventing similar incidents down the line.

The Human Cost and Economic Implications

While the financial impacts of Directline's closure are significant, the human cost cannot be overlooked. Many of the company's former employees had put in years of service, contributing to its growth and market standing. The abrupt nature of their termination adds a layer of hardship during an already challenging economic period.

Economists argue that the broader economic implications of the closure could be mixed. On one hand, the market may adjust to the loss of Directline, with other players stepping in to fill the void. On the other hand, the sudden influx of unemployed individuals could strain an already tight job market, creating further economic ripple effects.

As stakeholders navigate these turbulent times, the lessons learned from Directline's downfall will hopefully lead to stronger governance practices and a more resilient insurance market in Kenya.

Write a comment